CRS Expert® is a new RegTech software solution from Centenal. In this article I’ll explain the origins of Centenal and their rationale for building CRS Expert®.

I was first introduced to Centenal a couple of months ago in a coffee shop in St Helier. I had been contacted by co-founder Betty Sun to see if I’d be interested in reviewing their product and introducing it to businesses in my core markets of the Crown Dependencies and British Overseas Territoties.

Since then Centenal has been recognised in the Top 10 RegTech Solution Providers by APAC CIO Outlook. See here for the full review.

Not just another reporting solution

Initially, I was sceptical about another CRS reporting tool. There are a number of standalone reporting systems in the market, and most of the trust administration and wealth management platforms now include integrated FATCA and CRS reporting functionality.

The challenge of the annual reporting cycle for both FATCA and CRS is becoming well understood, even if keeping up with the changes in XML schemas and validation rules becomes more onerous each year.

However, after only a few minutes looking at Centenal’s software I realised that this was something entirely different that went far beyond just the reporting cycle. Before I go into this in more detail, who are Centenal?

Built on sound legal principles

Centenal was was founded in 2017, in Singapore, by lawyer Zac Lucas. His aim is to help financial institutions overcome the many on-boarding, data monitoring and reporting requirements imposed by the rollout of the OECD’s Common Reporting Standard (CRS) across the globe. After two years of development and testing, Centenal has launched CRS Expert®, its patented software which provides a complete end-to-end CRS solution.

Zac Lucas has over 20 years practising law, including time advising on international regulatory law. He has also lectured extensively on CRS. As a result he has considerable expertise and experience in advising private banks, trust companies, asset managers, advisers and government authorities on the practical implementation of CRS.

“Anyone professionally involved in the fiduciary or corporate service industries must understand and apply the CRS correctly,” Lucas states, “and this means a great opportunity for us with our CRS Expert® solution. The software is designed precisely to make it dramatically easier for FIs around the world, to comply internally and externally with the many demands imposed by the CRS.”

Lucas reports that Centenal was a concept he had thought about for several years before he finally committed to fund the idea and leave the immediate world of legalese.

“I had been close to launching the company in November 2016, but for a number of reasons I didn’t commit then,” he recalls. “However, I was emboldened by the great opportunities I saw, and in August 2017 finally decided to form Centenal.

Lucas reports that the original idea was that Centenal would create technology that could analyse a set of circumstances and provide regulatory outcome analysis.

“I chose the OECD’s CRS as the first proof of concept,” he explains, “as the CRS was then, and still is, seen as very difficult to understand and implement, so it was a real test of whether the team we put in place could create an algorithm around the CRS to drive fully automated reporting.”

The result of the enormous amount of intensive work that followed Centenal’s creation in 2017 was the launch of CRS Expert®, Centenal’s digital CRS compliance and reporting solution.

The ongoing CRS challenge

Lucas explains that the CRS and its application globally is an ongoing challenge. He reports that the OECD (acting via the Global Forum) will commence CRS peer reviews in 2020, and that this has lead domestic tax authorities to issue domestic audit requirements.

The final quarter of 2019 is expected to be filled with frustration, as Financial Institutions rush to meet CRS audit requirements, ranging from the need to correctly segment their client base according to various CRS sub-classifications (new, existing, excluded, undocumented accounts), implement and demonstrate that procedures are in place to properly detect and document changes in account holder circumstances, and manage and deter risk of non-compliance or anti-avoidance behaviour.

The audit process will (in many cases) be the first time that Financial Institutions and their compliance teams will be tested on the quality of their CRS reports. Lucas explains that in his experience many Financial Institutions have struggled to make an adequate investment, whether in staff training, systems and processes or modern IT infrastructure, and that audit failures will probably occur not in the initial classification and reporting of the client, but due to lack of proper monitoring of the status of client accounts.

Let’s now get back to the software and understand why I saw CRS Expert® as different from the many other reporting solutions. Up to now financial institutions have been focusing on the challenge of producing the reports. This is done with a snapshot of positions at the end of the previous year. What is missing from most reporting procedures is the ongoing monitoring of beneficial owners and controllers and the impact those changes in structures can have on their reporting obligations.

On-boarding, Monitoring & Reporting

The software can either operate standalone or be integrated into other administration and compliance systems using its suite of APIs. It has been built with integration in mind and uses the most up to date software techniques.

The software provides functionality across each stage of the CRS reporting cycle; On-boarding, Monitoring and Reporting.

A visualized graphical user interface combined with CRS and ultimate beneficial owner (UBO) computational algorithms allow users to take advantage of the following features:

- Paperless client on-boarding

- Centralized compliance and data management

- Automated CRS analysis

- Automated UBO analysis

- Integrated CRS/UBO analysis

- Centralized CRS/UBO monitoring, including automated change analysis

- Automated CRS XML conversion

- Exportable CRS XML report

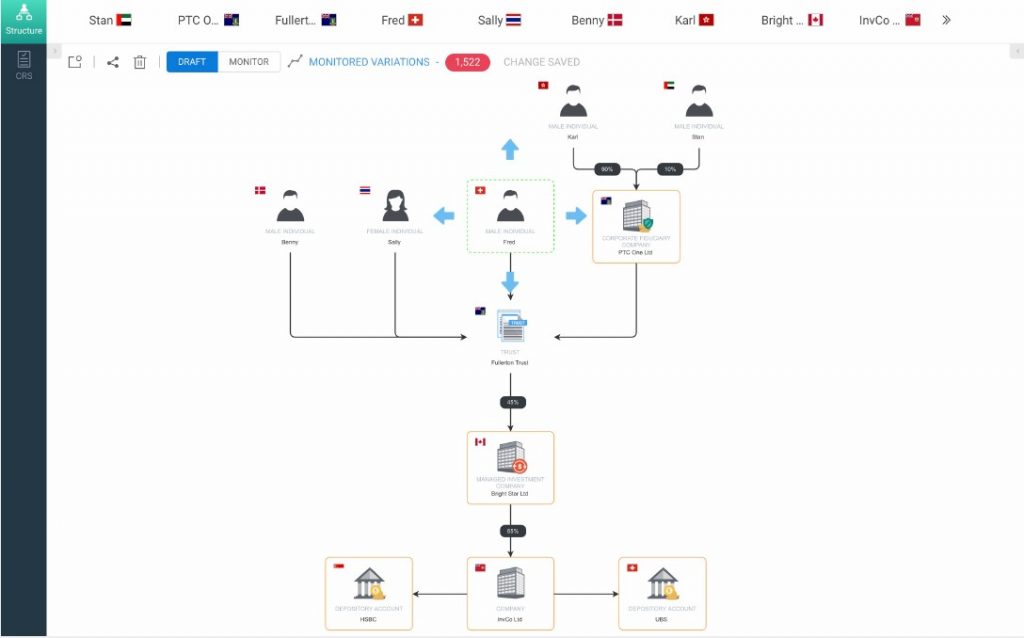

The diagram below shows a typical client structure digitally recreated.

The software is capable of automatically calculating each UBO of the client structure. Over 80 unique icons are contained in the software representing various entities, including not only trusts, but also companies, foundations and partnerships.

Data may be input and retrieved during the on-boarding phase, as well as later during practical administration of the trust structure. E-signature of a digital self certificate and other compliance and contractual documents may be facilitated, depending on local jurisdiction laws. API links to existing data may be used to enhance the collective data management function of the digital chart. Team members from administration, tax, compliance and front office RMs, both within the same office and across jurisdictions, may centralised use of the same digital chart.

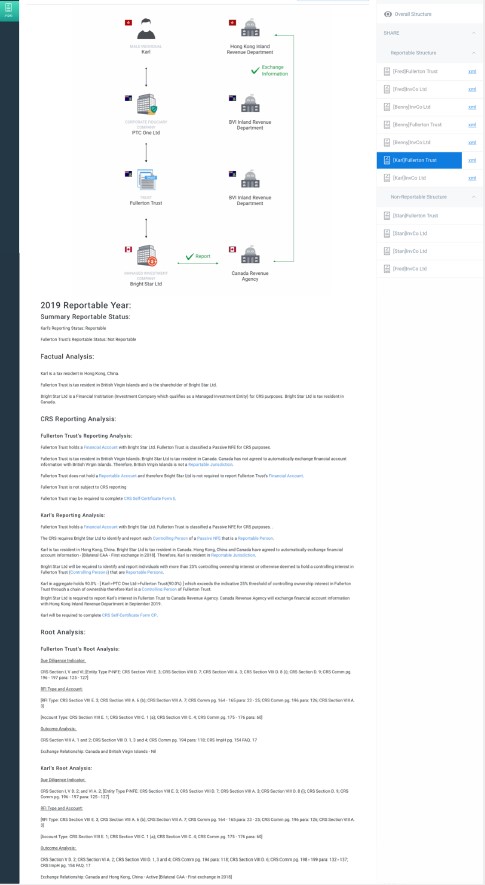

The diagram below shows the automated CRS outcome analysis for the Trust structure illustrated above. The automated CRS analysis function provides compliance teams with analytical support and a digital audit trail. Standardised reporting is therefore possible with reduced risk of mistakes and consequent misreporting.

Integration

CRS Expert® is a Single Page Application designed for easy API integration with existing data management platforms. API integration is available, with client data pulled and pushed to and from CRS Expert®.

Centenal is in the process of integrating CRS Expert® onto a number of banking and financial platforms as an easily utilised integrated API.

If you would like to learn more about CRS Expert either from an end user perspective or for potential integration into your own software platforms, then please contact me. I am in regular contact with Zac Lucas and Betty Sun and can arrange an online demonstration or meetings to discuss your requirements.

One Response